When you face a life-changing decision like divorce, what do you think you will find more valuable: Someone to make you feel better by saying that nothing has to change, or someone who will give it to you straight, no chaser?

When you face a life-changing decision like divorce, what do you think you will find more valuable: Someone to make you feel better by saying that nothing has to change, or someone who will give it to you straight, no chaser?

I feel strongly that not enough people in the world of divorce professionals will genuinely tell it like it is. They tell you what you want to hear, which can lead you to make some stupid mistakes. Easily Avoidable Mistakes. Mistakes that need not happen!

1.) I tell it like it is.

Your household income as a couple will now be supporting two households, so yes, things will change. Let me guide you through that change with some simple points.

2.) Radically, let me help you not be stupid!

Here are a few things that I repeatedly see when it comes to divorce. Settlements are agreed to (sometimes even ordered by a judge!), then the people come to me after the fact confused and bewildered. I read through their decree and just shake my head. Please, please, please – don’t make these mistakes!!

3.) The settlement doesn’t take taxes into effect – AT ALL!

We all know that line about death and taxes being the only two things that are certain. Unquestionably do not agree to a settlement without knowing the tax implications!

People often find that the tax burden on their half of the marital assets is significantly higher than their spouse’s, making their “half” of the assets worth substantially less than they thought! And taxes aren’t just income taxes; they can pop up in other ways as well.

More specifically, don’t expect your attorney to do this! Attorneys know the law. They are not accountants or financial advisors. I actually had an attorney tell me recently that she didn’t think it was worthwhile to look at her clients’ finances in detail. Just divide them down the middle and move on.

Take Control of Your Future

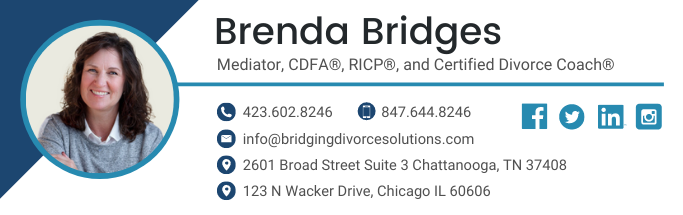

When you consider divorce, or if you know someone who is contemplating divorce, one of the biggest realities for those in the divorce process is the financial settlement and financial analysis post-divorce. Get the assistance of Brenda Bridges, a Mediator, Certified Divorce Financial Analyst® (CDFA®), RICP® Retirement Income Certified Professional, and Certified Divorce Coach.

Brenda provides step-by-step guidance on matters related to divorce. With a wide range of experience and expertise related to divorce issues, Brenda will simplify the process and provide much-needed clarity in areas such as long-term tax consequences, asset, and debt analysis, dividing pension plans, continued health care coverage, stock option elections, protecting support with life insurance, and much more.

Schedule Your FREE Discovery Call Today!

Divorce coaching and educational services provided through Bridging Divorce Solutions, LLC. Bridging Divorce Solutions, LLC is not affiliated with Cambridge. Examples are hypothetical and for illustrative purposes only.

Brenda Bridges

Mediator, MAT, RICP®, CDFA®, CDC®