Navigate the Financial Aspects of Divorce

Divorce Financial Planning Services in Tennessee

Your financial divorce will be a pivotal transition in both your lives. You and your spouse will be making major decisions with far-reaching consequences and will undoubtedly benefit from the expert guidance we provide during the divorce process.

Divorce financial planning helps you both make smarter decisions by providing more clarity for the complex financial decisions that must be made.

At Bridging Divorce Solutions, we help divorcing couples navigate this difficult financial landscape in a respectful, confidential, and affordable manner.

For most couples, divorce may be the most wrenching transition of their lives. The slings and arrows are felt emotionally and financially and it’s easy to allow events to spin out of your control.

You will often be required to make a host of major decisions that will have long-term consequences. Even the most financially sophisticated people often need expert guidance during a divorce.

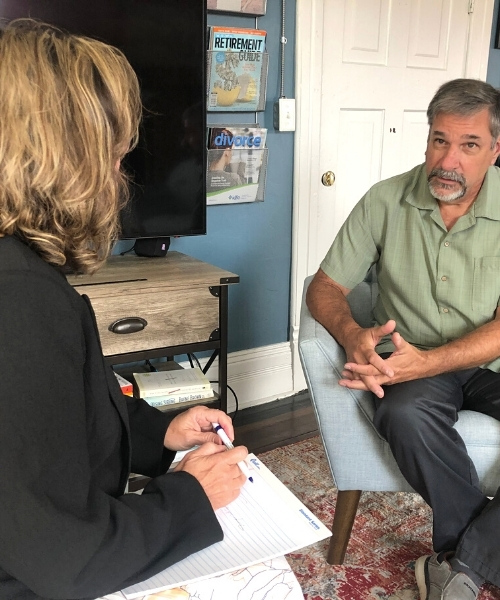

Brenda Bridges, our Mediator, CDFA®, and Certified Divorce Coach® will help you with the financial planning needed to make the best possible decisions. We point out to you possible pitfalls. And we provide financial guidance that even some attorneys may not always provide.

Make Sound Financial Decisions

The decisions you make during your divorce will affect the rest of your life. Just as important to know is that those same decisions are difficult, if not impossible to change without additional legal expense and court involvement. But how do you know whether your divorce settlement will lead towards financial freedom or financial ruin down the road? In these tough economic times, it’s crucial that you get the right information so that you can make sound financial – not emotional – decisions.

- What if child support doesn’t cover all of your child’s expenses?

- Do you know how much of your spousal support you’ll get to keep after taxes?

- What are the health care benefit options for you and your children?

- Are you really getting the assets you need for your unique circumstances?

- Are you sure you can afford to keep the house?

- Do you understand the tax implications of dividing retirement accounts?

- Do you know that there are a multitude of settlement options that you may not have considered?

Bridging Divorce Solutions will show you how to avoid some of the most common financial mistakes people make during the divorce process – as well as show you the sources of money that may be available to you as a result of your divorce.

Our Philosophy

We help couples divorce by implementing a non-adversarial process, one that is not financially confusing and not unreasonably costly. Using alternative dispute resolution instead of, or in addition to, the court system means families can own their decisions and design their lives during and after divorce.

Knowledge and Expertise

Our certified Mediator and CDFA® is a trained financial professional who can help you navigate the divorce process and all financial aspects of divorce.

Personalized Strategy

We recognize that each divorce is different and carefully plan a custom strategy that is right for you and your solution, no matter what stage you are.

Confidential

Our work together is sensitive, discreet and confidential, while we provide a customized, non-judgmental safe-haven keeping you focused and on task.

LET’S GET STARTED

Schedule a Discovery Session

At Bridging Divorce Solutions, we help determine the short-term and long-term financial impact of a proposed divorce settlement to make sure it works now as well as down the road. We examine and analyze the numerous financial issues of a divorce, providing our clients, their lawyers, and CPAs with data to help strengthen their case. We help our clients avoid the common financial mistakes of divorce by offering important insight into the advantages and disadvantages of various settlement proposals.

Schedule a personalized strategy session with Brenda Bridges, a Mediator, Certified Divorce Financial Analyst® (CDFA®), Retirement Income Certified Professional RICP®, and Certified Divorce Coach®.

During your strategy session, she will:

- Explore your divorce options and get clear on the right solution for your situation

- Review your finances and explore creative settlement ideas

- Map out a plan for transitioning to the next phase of your life

- Identify your biggest fears and decide the best way to address them

- Connect you with any other resources you’ll need in your process

News and Resources

How to Divorce Without Hurting Your Kids

January 19, 2023

Blog

Navigate the Financial Aspects of Divorce Divorce Financial Planning Services in Tennessee Your financial divorce will be a pivotal transition…

Read More

The gifts of divorce, places where you may surprisingly find gratitude

November 23, 2022

News

Navigate the Financial Aspects of Divorce Divorce Financial Planning Services in Tennessee Your financial divorce will be a pivotal transition…

Read More

What is a Certified Divorce Financial Analyst® and why do I need one?

November 23, 2022

News

Navigate the Financial Aspects of Divorce Divorce Financial Planning Services in Tennessee Your financial divorce will be a pivotal transition…

Read More

How to co-parent happy and healthy kids after divorce

November 14, 2022

Resources

Navigate the Financial Aspects of Divorce Divorce Financial Planning Services in Tennessee Your financial divorce will be a pivotal transition…

Read More

Webinar: Ten Things Couples Should Do As They Near Retirement

November 1, 2022

Event

In this episode, Advice Chaser hosted an online webinar titled, ‘Ten Things Couples Should Do As They Near Retirement.’

Read More

What’s collaborative divorce, and is it right for my family and me?

October 11, 2022

Resources

One of the most common questions I hear during my first call with someone who wants a divorce or heard…

Read More

Podcast: The Cost of Two Households

September 6, 2022

Event

In this episode, Purse Strings host Maggie Nelson talks with our very own Brenda Bridges, a Certified Divorce Financial Analyst®.

Read More

Three simple steps to starting divorce the right way (and having the best outcome)

August 27, 2022

Resources

One of the most common questions I hear during my first call with someone who wants a divorce or heard…

Read More

Podcast: Dividing Assets After A Long Marriage

August 17, 2022

Event

In this episode, Modern Divorce Podcast host Billie Tarascio talks with our very own Brenda Bridges, a Certified Divorce Financial…

Read More

For my 50th birthday, I got a divorce (and no, it wasn’t what I asked for!)

August 8, 2022

Resources

Divorce is often like this – especially for the person not asking for the divorce or separation. Frequently, there’s a…

Read More

Stumbling Into My Strength, Where’s Your Struggle Leading You?

August 5, 2022

Resources

I needed to retreat from the world a little bit and think. While part of me feels like I need…

Read More

Webinar: Understanding the Process of Divorce

July 8, 2022

Event

Watch Advice Chaser’s recent webinar to discuss ‘Women’s Guide to Divorce’, as Brenda Bridges, with Bridging Divorce Solutions joins to…

Read More