Visions of retirement may have danced in your head for a while now. That was before divorce became part of the conversation.

You set aside a comfortable retirement nest egg that calculated golden years spent together as one household. Now those same funds will have to support not one but two households. One study showed post-divorce single women’s income dropping by 45%, custodial parent’s income dropping a whopping 52%. And with these declines, it’s highly unlikely expenses will drop to the same degree.

What was the picture before divorce became part of your world? Travel? Vacation home? Watching the grandkids’ soccer games? Having time to go to yoga or learn bridge?

Baby Boomers are now divorcing at two times the rate from the late 20th Century. As our life expectancies continue to increase, our attitudes about divorce continue to evolve. And while it’s not still rapidly growing, Boomer divorce appears here to stay.

Between 1990 and 2015, the divorce rate for 55 to 64-year-olds more than doubled. For the 65-and-older crowd, that number more than tripled. 2

When divorce enters your world after age 50, and it’s doing so at increasing rates, the ramifications can be vastly different than for those who have more time to earn and save before retirement. The sad fact that what is now being called “gray divorce” can be financially devastating, especially if you’re close to a planned retirement.

That comfortable nest egg must now fund two of everything: Two residences, two cars, separate vacations, separate trips to see the grandkids, etc. This duplication can eat into a retirement fund at an alarming rate.

For Richer or Poorer

More than likely, you will face some difficult choices. For example, you can either reduce your standard of living or retire later and increase your savings. Or both.

You may both have to consider selling the marital home to split the proceeds so both parties can downsize to an affordable dwelling. That equity can provide income to live on when invested, so selling may make more sense than one party trying to keep it.

In Sickness and in Health

Illness and disability may also force some difficult choices. As a couple, there is some comfort in knowing that if one of you becomes ill or disabled, the other partner will be there to help care for you. However, after divorce, that duty could fall to your children or hit that nest egg again when you need to hire caregivers.

If you find yourself considering divorce after age 50, one of the very best things you can do to minimize the damage in the process is to be as cooperative with your spouse as possible, educated about your options, and prepared with organized financial documents.

Most importantly, to minimize the financial toll, be sure to hire a financial advisor trained in divorce finances along with that attorney or mediator. They can help you understand the impact of different decisions you and your spouse will make and how they can play out financially in this next stage of your life.

With the children likely being grown, the major devastation of a gray divorce will be the finances and your emotions. Certified Divorce Financial Analysts® (CDFAs) are specially trained in divorce finances and can help you cover all of the critical issues. For example, they can help you see if you can keep the house, if spousal maintenance is required, and how to split a pension (if you can). Beyond the divorce, a CDFA® who is also a financial advisor can help you make wise financial planning and budgeting decisions based on the changes in your life post-divorce.

When you add a CDFA® to your team, you compliment the expertise of other professionals like your attorney or divorce coach. But, ultimately, your best bet for survival, let the professionals handle the finances and legalities; you can take care of your wellbeing and be in a mindset appropriately equipped to handle the decisions you are facing.

Take Control of Your Future

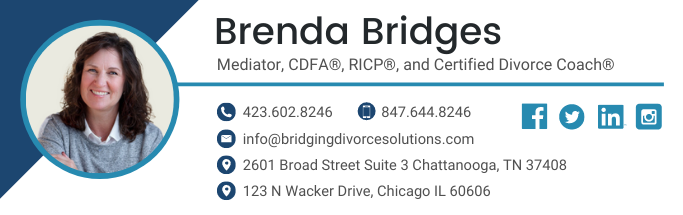

When you consider divorce, or if you know someone who is contemplating divorce, one of the biggest realities for those in the divorce process is the financial settlement and financial analysis post-divorce. Get the assistance of Brenda Bridges, a Mediator, Certified Divorce Financial Analyst® (CDFA®), RICP® Retirement Income Certified Professional, and Certified Divorce Coach.

Brenda provides step-by-step guidance on matters related to divorce. With a wide range of experience and expertise related to divorce issues, Brenda will simplify the process and provide much-needed clarity in areas such as long-term tax consequences, asset, and debt analysis, dividing pension plans, continued health care coverage, stock option elections, protecting support with life insurance, and much more.

Schedule Your FREE Discovery Call!

Divorce coaching and educational services provided through Bridging Divorce Solutions, LLC. Bridging Divorce Solutions, LLC is not affiliated with Cambridge. Examples are hypothetical and for illustrative purposes only.

Supporting Information

http://www.marripedia.org/effects.of.divorce.on.financial.stability

Matthew McKeever and Nicholas H. Wolfinger, “Reexamining the Costs of Marital Disruption for Women,” Social Science Quarterly 82, (2001): 202-217. The findings were much the same as those of Morrison and Ritualo a year earlier: Donna R. Morrison and Amy Ritualo, “Routes to Children’s Economic Recovery After Divorce: Are Cohabitation and Remarriage Equivalent?” American Sociological Review 65, (2000): 560-580.