As soon as you begin to contemplate divorce, the nauseating, panic-attack-inducing realization of losing half of your net worth kicks in, and you find yourself wondering if it’s even worth it to consider leaving if you’re going to end up broke and starving.

There are ways to ensure that you don’t destine your financial future to disaster. First and foremost, be fully informed of the creative settlement possibilities open to you by involving a financial advisor specializing in divorce on your team.

Here’s a potential example of what can happen without accurate and complete information:

Let’s imagine a couple married 24 years had gone to an attorney together and were entirely amicable. The attorney makes it clear that he could only do their document preparation since he is ethically bound to represent only one party. That is ok, but they ask how they would determine their property division. He responds, “This is a community property state, so we’ll just divide each asset and each debt exactly 50/50.” The couple has been married a long time, their finances are somewhat complicated, so they don’t feel like that is the smart thing to do.

So they ask people in their circle what they did in similar circumstances. A previously divorced coupe refers them to a CDFA®, Certified Divorce Financial Analyst, to explore options.

After gathering all of their financial documents and completing the analysis, the CDFA® puts together two reports for the clients. The first reflects an exact 50/50 split, as the attorney had suggested. The second was a creative settlement solution that also resulted in a net 50/50 split but considered tax planning and consequences and each party’s individual needs and circumstances as they planned for the next phase of their lives.

In this hypothetical situation, it would not be unusual for the creative settlement solution for a couple with a combined net worth of $800,000 to result in an additional $20,000 EACH to their bottom line by incorporating some financial intelligence to determine their settlement. That’s real money! Most divorcing couples would be thrilled knowing that they saved $40,000!

Don’t go into this blind. There are so many ways to ensure that both of you get to keep more of your own money. First, contact the right experts to build your team. We’d love to help you! Call us today.

Take Control of Your Future

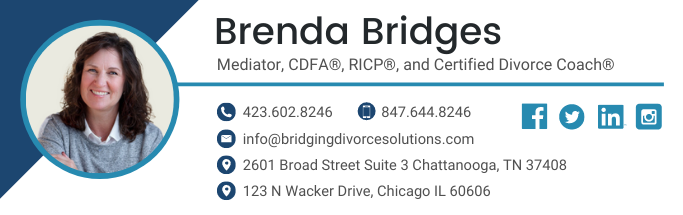

When you consider divorce, or if you know someone who is contemplating divorce, one of the biggest realities for those in the divorce process is the financial settlement and financial analysis post-divorce. Get the assistance of Brenda Bridges, a Mediator, Certified Divorce Financial Analyst® (CDFA®), RICP® Retirement Income Certified Professional, and Certified Divorce Coach.

Brenda provides step-by-step guidance on matters related to divorce. With a wide range of experience and expertise related to divorce issues, Brenda will simplify the process and provide much-needed clarity in areas such as long-term tax consequences, asset, and debt analysis, dividing pension plans, continued health care coverage, stock option elections, protecting support with life insurance, and much more.

Schedule Your FREE Discovery Call Today!

Divorce coaching and educational services provided through Bridging Divorce Solutions, LLC. Bridging Divorce Solutions, LLC is not affiliated with Cambridge. Examples are hypothetical and for illustrative purposes only.