In divorce, the life you knew it is falling apart. The natural reaction is to cling to what you know and salvage what you can. When everything you thought you knew about your life and your future is in pieces, it can be a struggle to make sense of the fragments that remain. It’s typical to want to stay in the house and retain some appearance of normalcy. While it seems like you are providing stability by staying in the family home, think it through. It may be a very high-priced mistake.

You’re scared. Still, be smart.

Let’s look at the big picture. A house is somewhere to live. Unless you’re an Airbnb Superhost, it does not provide any income to support your lifestyle. If you and your spouse lived there for an extended time, there is likely a relatively large chunk of equity confined in those walls. If you get the home in the divorce, it could be the largest asset in the settlement.

Do the math. (I know arithmetic was probably not your favorite subject, but this can pay off in the long run.) Let’s assume the house has a market value of $450,000, and there is $350,000 in equity. Half of that equity is yours as marital property, but the other half is your spouse’s. So if you keep that home, then a total of $350,000 of your settlement will be tied up in that property. That same money could generate over $14,000 a year in income if invested conservatively. That’s a sacrifice of $14,000 in income every year before we even contemplate the costs of upkeep and maintenance to increase the revenue necessary for you to make ends meet.

But wait! There’s more. The potential tax impact down the road could be tremendous. If you were to sell the house while still married, the $350k capital gain would fall under the marriage exclusion of up to $500k and be tax-free. Once you transfer that home into your name, if you sell it now with a gain of $350k, the personal exemption is only $250k. Now you owe capital gains tax on $100k of profit or $15,000. Did your attorney remember to consider that in your settlement discussions? Yet one more reason I advocate for a mediated divorce with a certified financial neutral (CDFA®) to help.

And while you keep the home, you’ll also be paying property taxes every year on the house. And those are likely to go up annually as well. Depending on where you live, this can range from hundreds to tens of thousands of dollars.

Divorce is challenging; however, it’s also an opportunity for a fresh start, and getting off on the right financial footing is vital to your future. To ensure that you understand all of the ramifications of any property settlement you are considering, bring a Certified Divorce Financial Analyst (CDFA®) to shine the light on some of these issues. You only have one chance to get your settlement right. Take the time to gather information and make sure you are doing the right thing. It will be the best decision you ever made.

Take Control of Your Future

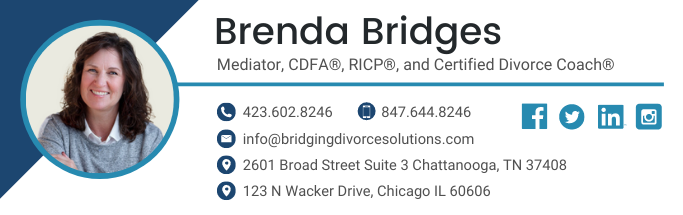

When you consider divorce, or if you know someone who is contemplating divorce, one of the biggest realities for those in the divorce process is the financial settlement and financial analysis post-divorce. Get the assistance of Brenda Bridges, a Mediator, Certified Divorce Financial Analyst® (CDFA®), RICP® Retirement Income Certified Professional, and Certified Divorce Coach.

Brenda provides step-by-step guidance on matters related to divorce. With a wide range of experience and expertise related to divorce issues, Brenda will simplify the process and provide much-needed clarity in areas such as long-term tax consequences, asset, and debt analysis, dividing pension plans, continued health care coverage, stock option elections, protecting support with life insurance, and much more.

Schedule Your FREE Discovery Call Today!

Divorce coaching and educational services provided through Bridging Divorce Solutions, LLC. Bridging Divorce Solutions, LLC is not affiliated with Cambridge. Examples are hypothetical and for illustrative purposes only.